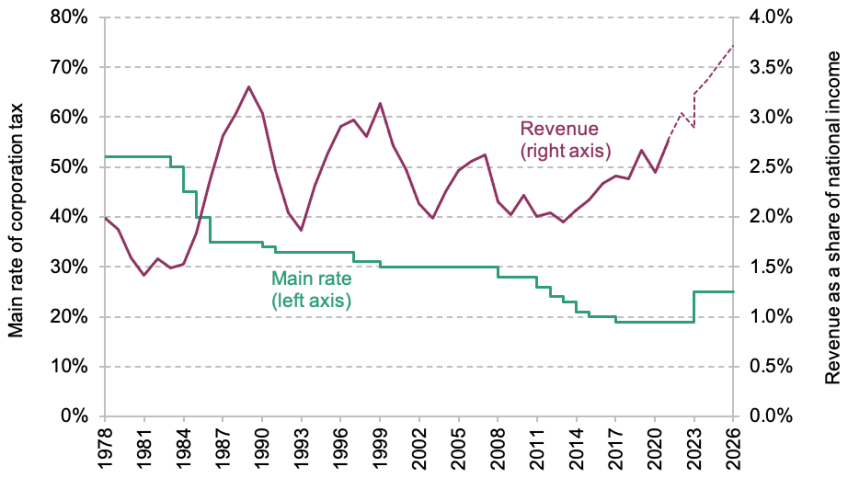

Excess Profit Taxes: Historical Perspective and Contemporary Relevance in: IMF Working Papers Volume 2022 Issue 187 (2022)

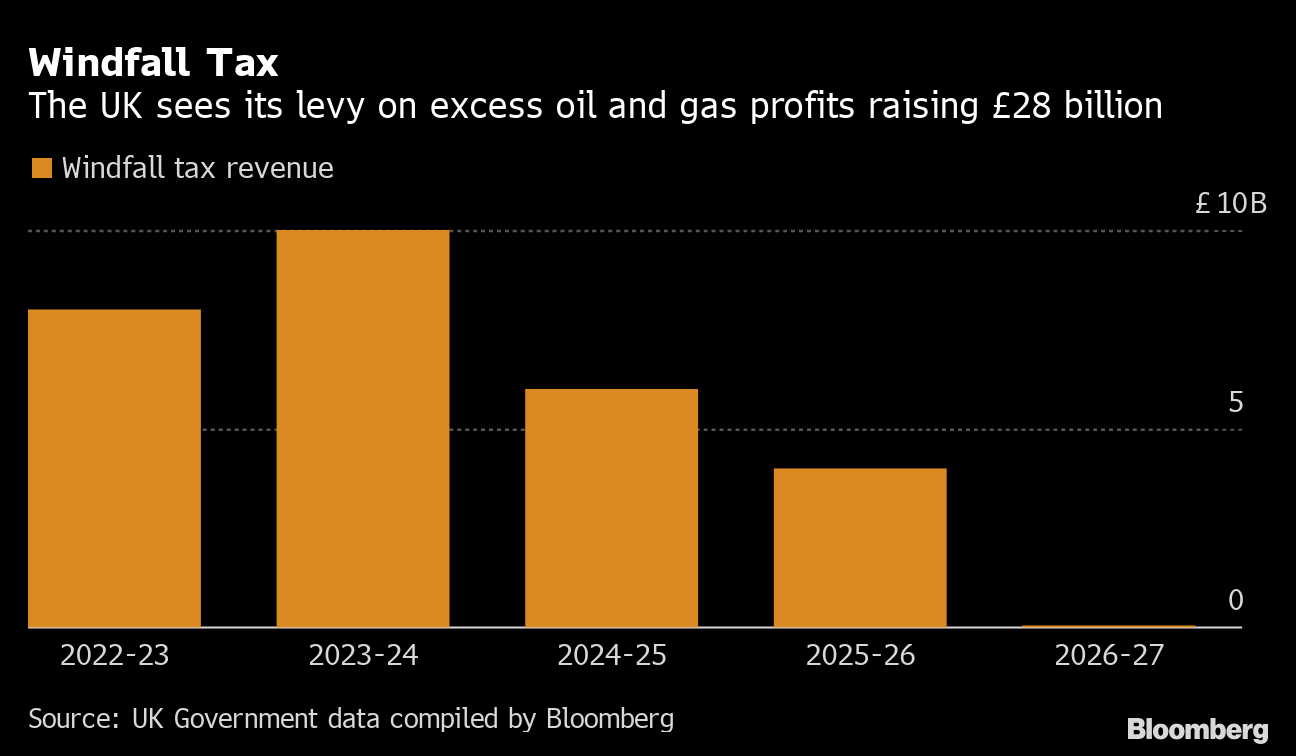

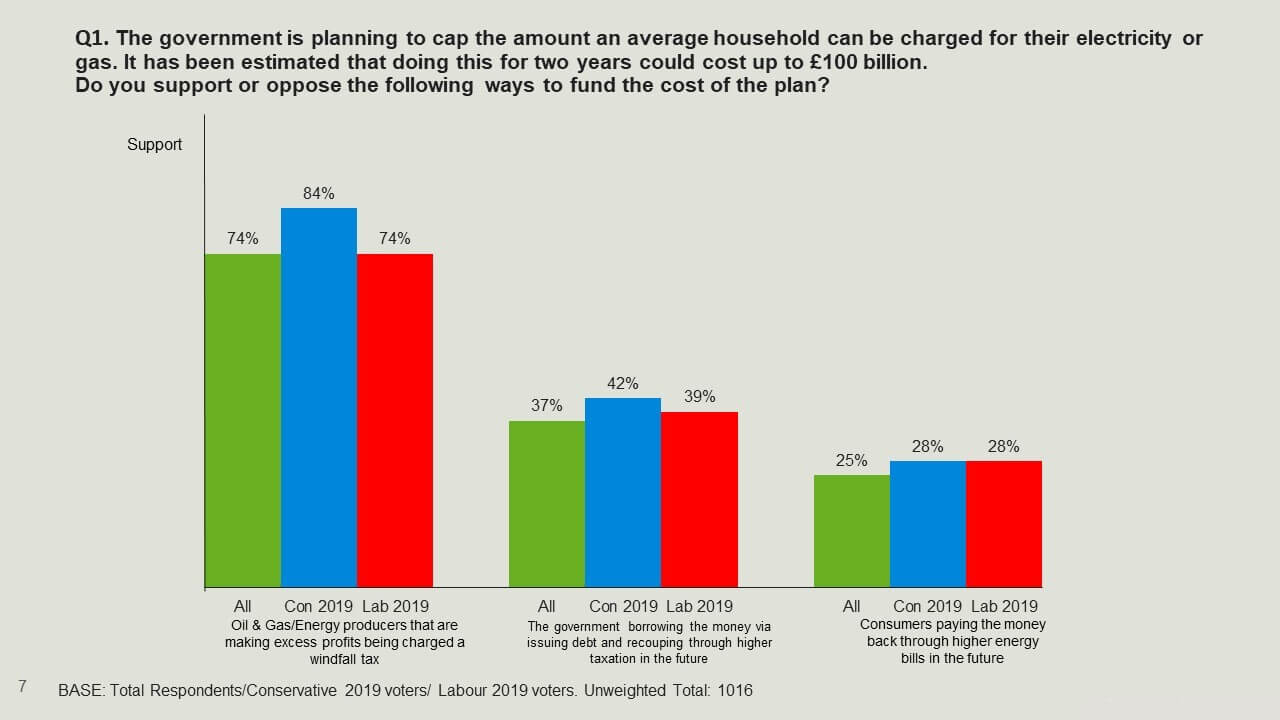

Survation | Public and Conservative voters believe windfall tax on energy producers should form a part of paying for energy bill cap | Survation

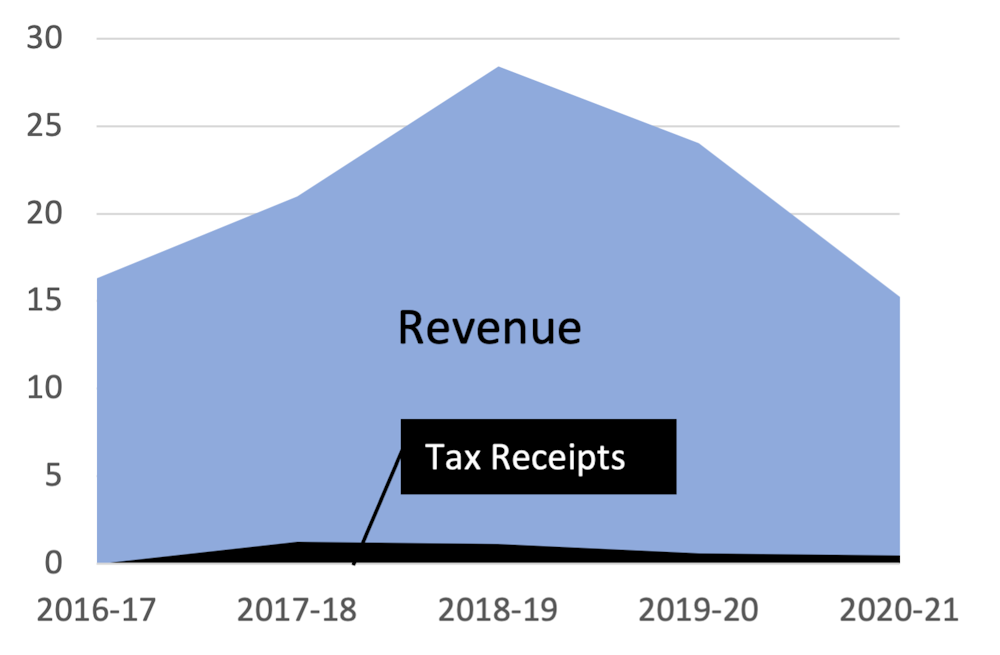

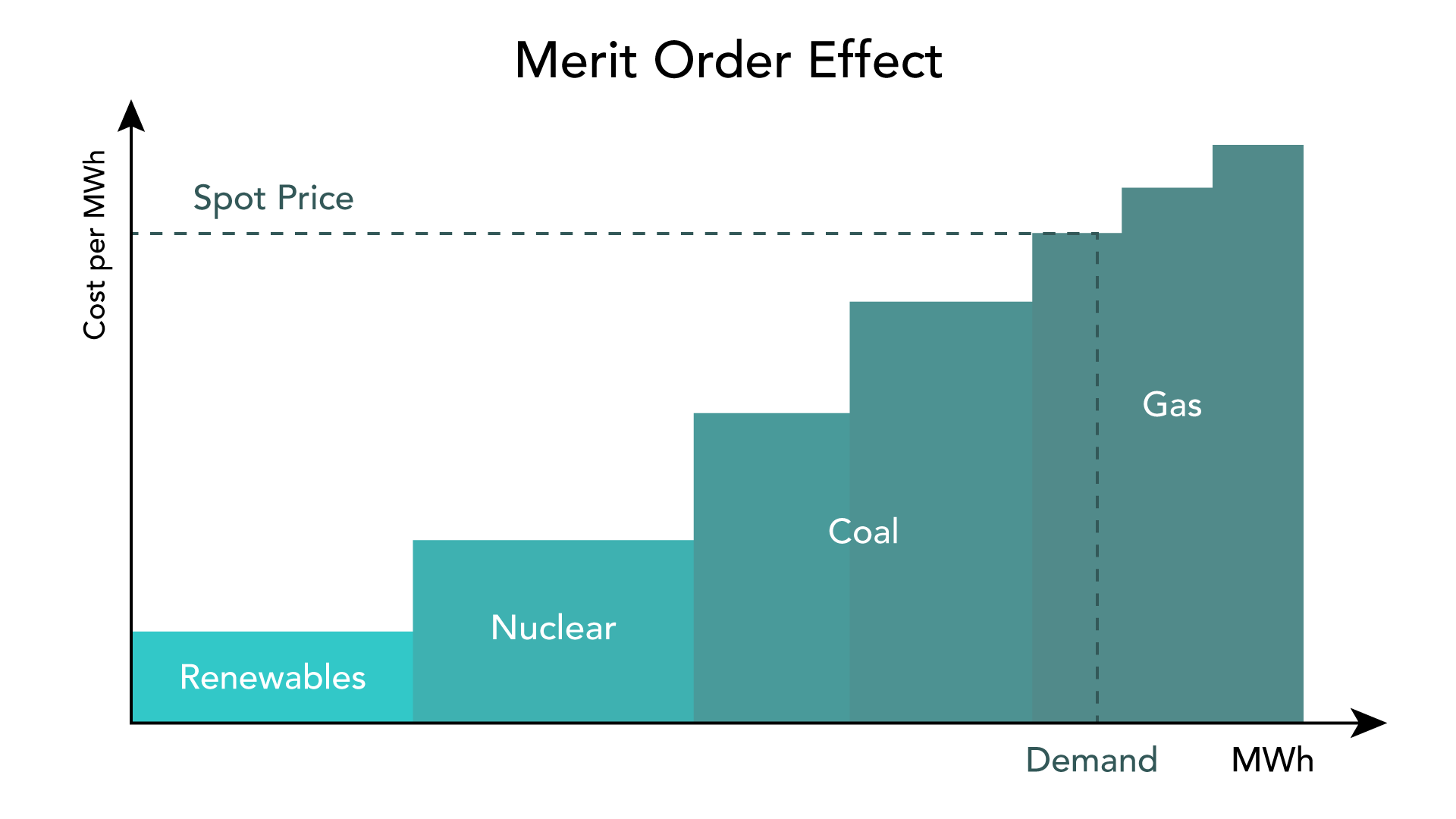

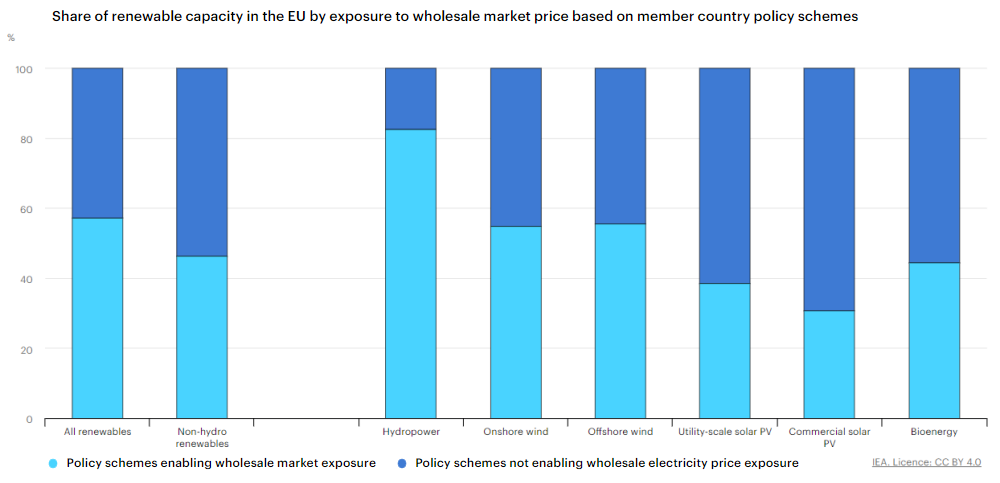

How to tax renewable energy firms for windfall profits from high wholesale electricity prices - Energy Post

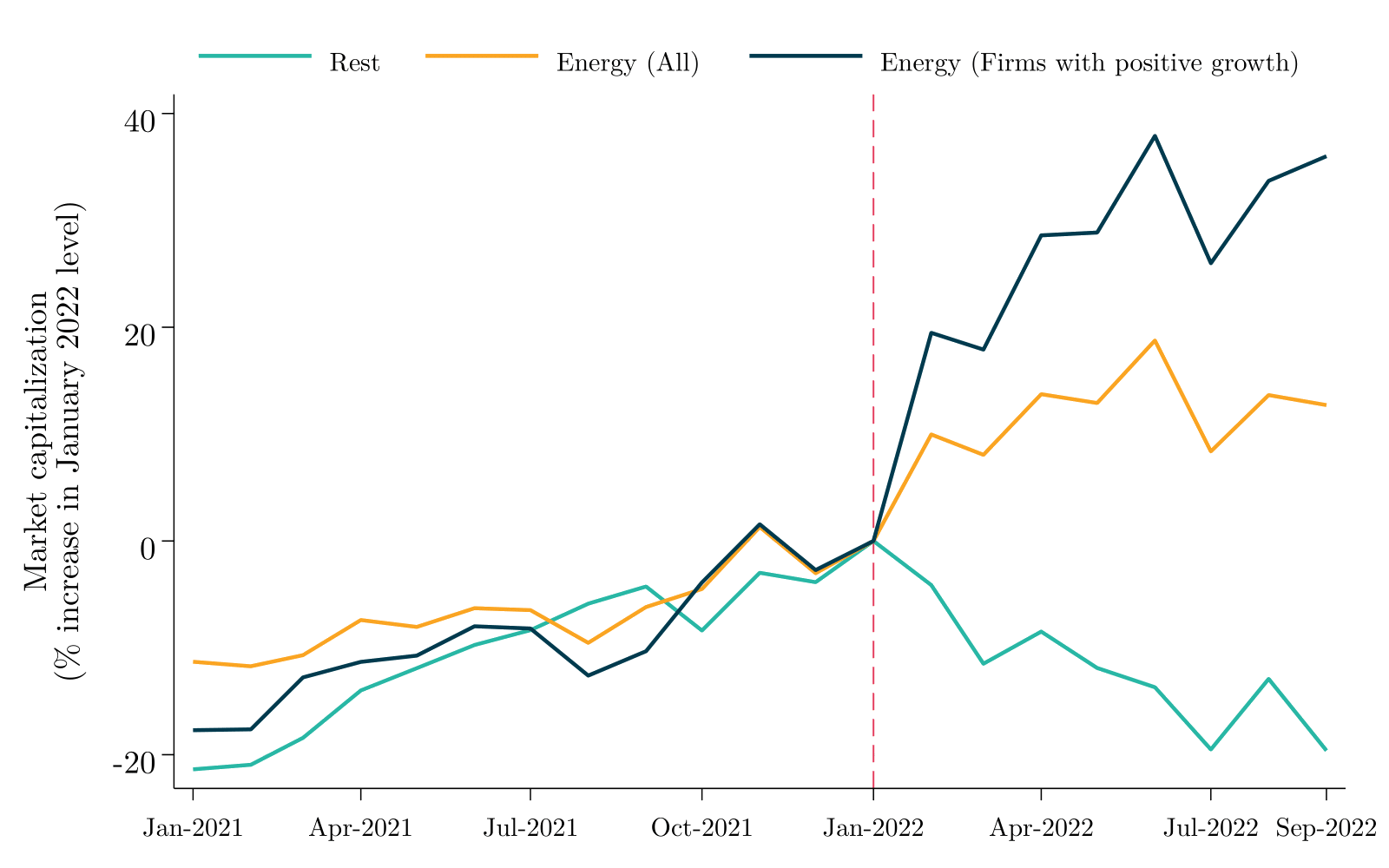

The effectiveness and distributional consequences of excess profit taxes or windfall taxes in light of the Commission's recomm