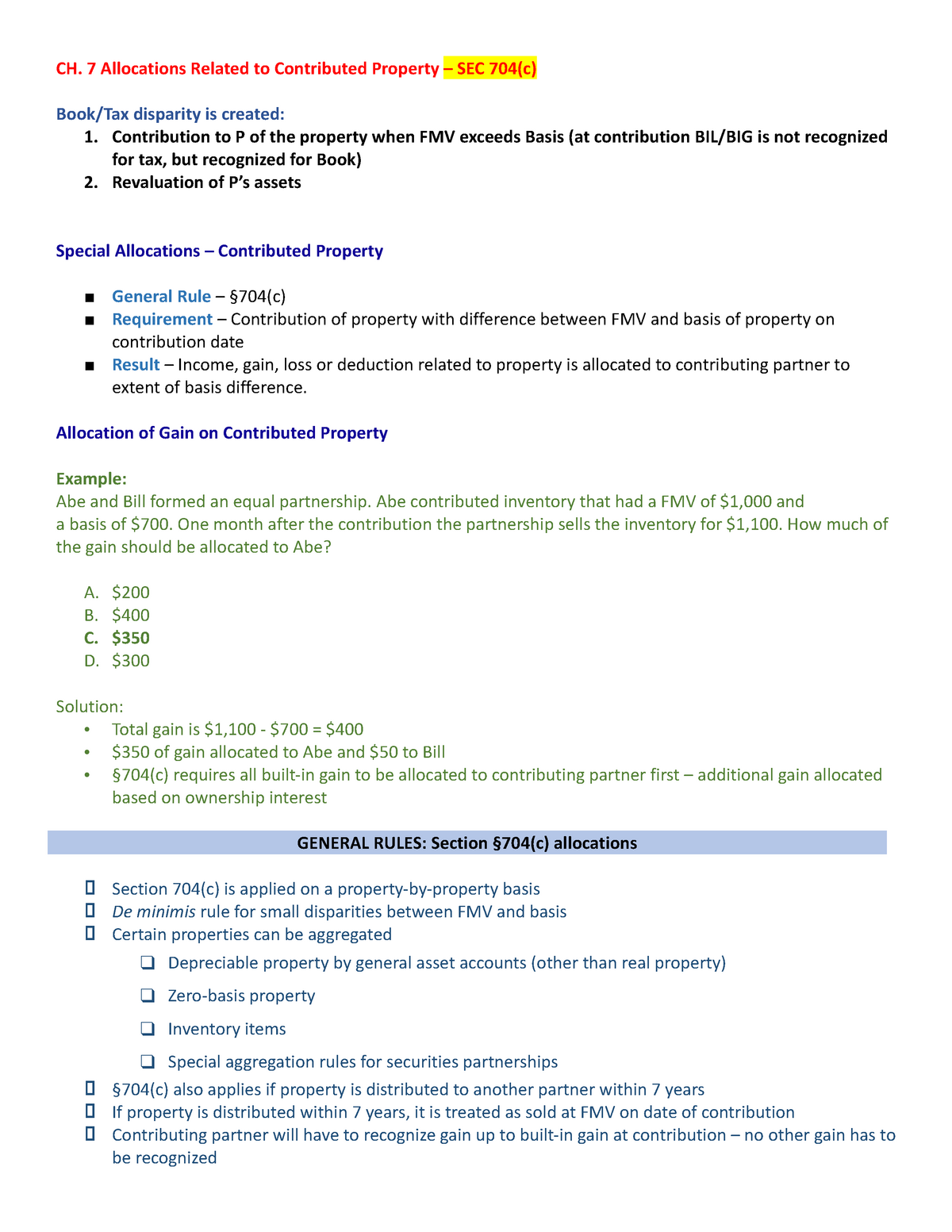

CH 7 notes - CH. 7 Allocations Related to Contributed Property – SEC 704(c) Book/Tax disparity is - Studocu

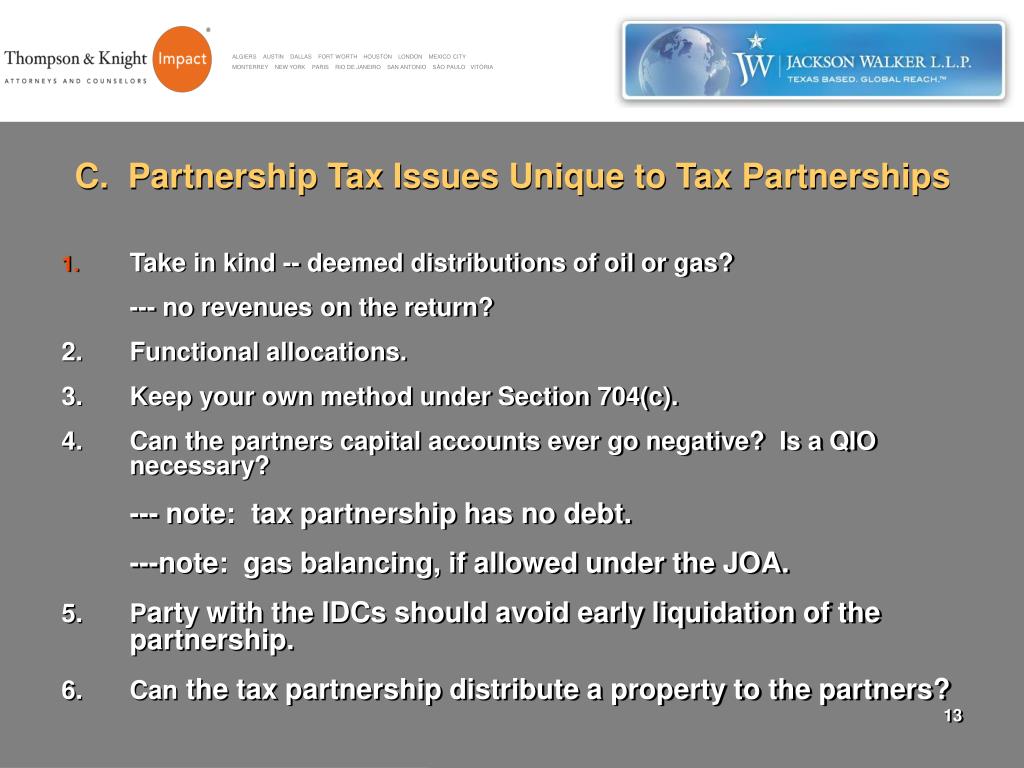

Disguised Sales and Other Mixing Bowl Provisions Howard E. Abrams Warren Distinguished Professor, USD School of Law November Copyright. - ppt download

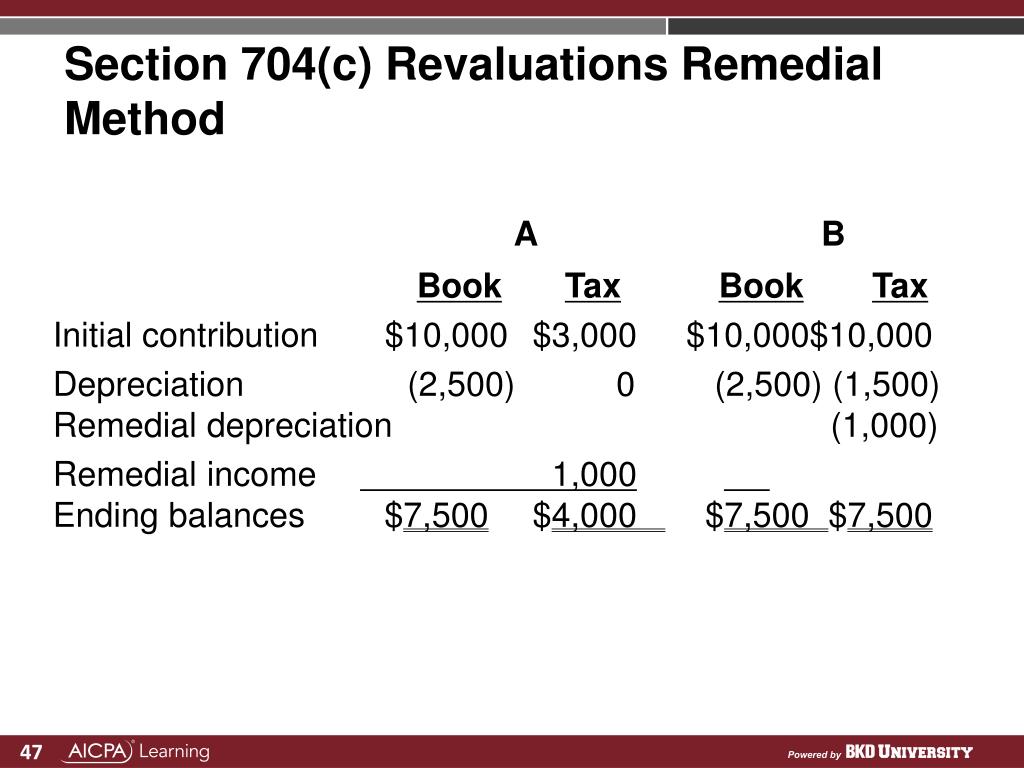

Partnership Taxation: Section 704C Special Allocation Rules Webinar (1 Hour) | CPE INC. | CPE Seminars, Conferences and Webinars