Landlords could claim £27,000 stamp duty reimbursement after changes made to tax rules - David Ebert Solicitors

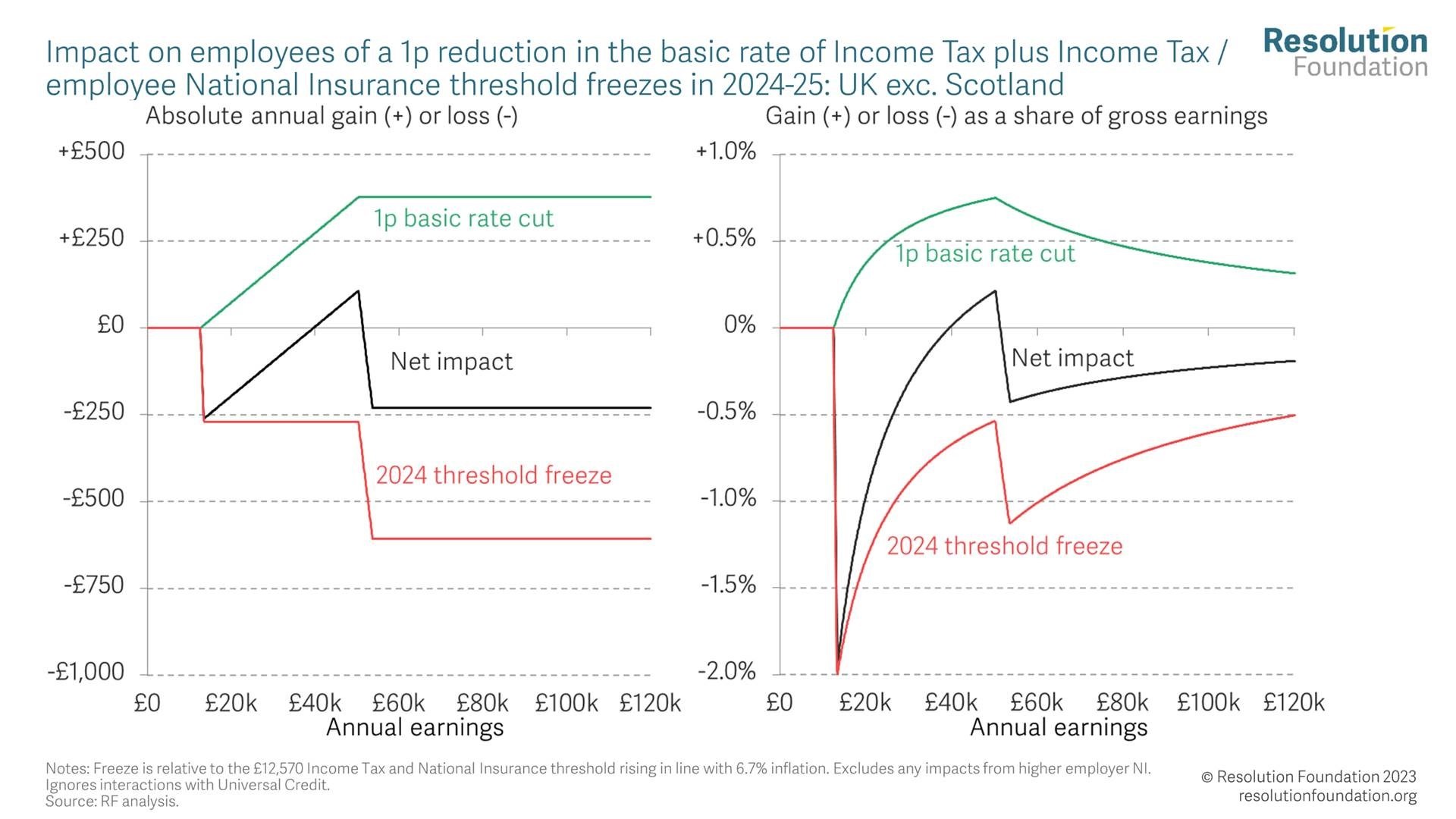

Resolution Foundation on X: "And how would this cut sit alongside *all* personal tax changes announced in this parliament? 💸 People earning £27,000-59,000 are better off overall 💷 Higher earners are worse

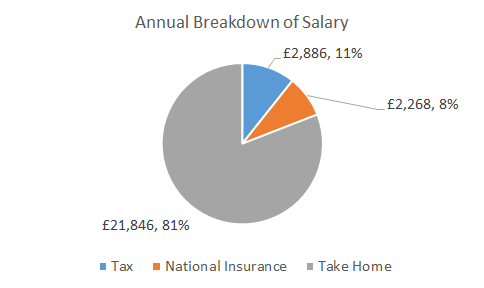

How much tax do I have to pay on an Income of 7.1L under the New Regime? - Income Tax - TaxQ&A by Quicko - Get answers to all tax related queries